The Economics of Accountability Journalism: What Price Is Right?

By James Breiner

The declining supply of high-quality accountability journalism, also referred to as investigative or watchdog journalism, can be viewed from an economic perspective as a pricing problem. This costly journalism has never paid for itself. It has been subsidized by advertising or by government, so its value to the audience has never been measured in a pure market environment. With the loss of advertising and staff cuts, accountability journalism has suffered. Now publishers, government, and the public are, in effect, negotiating in a new digital marketplace to establish a price for this valuable information service and who will pay for it.

Introduction: The old model collapses

The media industry is unusual because it operates in what economists call a two-sided market. On one side are consumers, who want to be entertained and informed. On the other are advertisers, who want to get their messages to the public. The advertisers and consumers are rivals for information. The public wants to know everything about a product or service offered by an advertiser, but that advertiser may want to share only certain information about the product and about itself. Accountability journalism, also referred to as “watchdog” or “investigative” journalism, focuses on the demands of the public and will often reveal information that could be embarrassing to an advertiser or, in the case of publicly subsidized media, the political leaders who control media budgets.

The economic value and the pricing of accountability journalism are critical today because of the media’s role in democracies as a counterbalance to political and economic power, the so-called Fourth Estate. High-cost accountability journalism has suffered mightily since the global economic recession of 2007 caused drastic reductions in print advertising at the same time that audiences and advertisers were migrating to digital media. U.S. newspapers saw their combined print and digital advertising revenue fall by 60% in eight years, and newsroom staff fell by 18,300, or 33% (Barthel, 2015). In Spain, to pick the most extreme example from Europe, 11,100 journalists have lost their jobs since the twin crises began (PR Noticias, 2014).

As the public and advertisers have stampeded to mobile devices, the traditional technology for measuring audiences and pricing media products has proven unsatisfying for both publishers and advertisers. Advertisers want to know not only the size of the audience, but its characteristics—income, location, interests, spending habits, hobbies, and more (Breiner, 2015a). “But for technical reasons, it is difficult to track a single user across all the devices they may use at home, at work or on the go—smartphone, tablet, laptop, desktop” (para. 5). That user of many devices will appear to be several different users to standard measurement software such as Google Analytics. Cookies—those bits of information placed on a user’s browser when they visit a website—track the user and give hints about their interests, but cookies do not work when the user moves from a browser into the walled gardens of mobile devices and applications.

The collapse of the old models has raised a number of economic and public policy questions. Who will pay for accountability journalism, and how much will they pay? The price has never been determined in a pure economic market because it has been subsidized by advertising or by government payments, either user fees or taxes. What benefit does this type of journalism have in society and in the marketplace? Is this journalism really a marketable product or is it a public good, like highways or fire protection or national defense, and therefore best paid for by government subsidies?

This paper will explore how digital publishers, advertisers, government, and the public are attempting to establish an economic value for accountability journalism, who should pay for it, and how much.

Setting value

An example of the value of accountability journalism can be illustrated by a Swiss Leaks investigation coordinated by the International Consortium of Investigative Journalists. The investigation showed how one Swiss bank, HSBC, knowingly protected clients engaged in illegal activities. The project involved 175 reporters from 56 countries and resulted in more than 400 articles in 65 different media (ICIJ, 2015). It is a sign of the economic crisis in the media that no single for-profit media outlet had the resources to execute an investigation as complex as this without the help and coordination of a nonprofit NGO, the ICIJ. The benefit to society of this report was to demonstrate a need for better international cooperation in bank regulation, but the cost to the media organizations in terms of time dedicated by expert personnel was significant.

High-impact accountability journalism can be executed on a smaller scale, but someone still needs to pay for it. A group of five young Mexican journalists who founded the investigative website Quién Compró (Who bought it?) researched the expense reports of Mexican senators and congressmen and reported that they had spent hundreds of thousands of taxpayers’ dollars on Harley-Davidson motorcyclesand a $60,000 SUV for a government agency of obscure purpose (Breiner, 2015b). The journalists at Quién Compró, who do investigative data journalism in their spare time, were filling a gap. Traditional media had cut newsroom staffs to the point where they could not do this kind of journalism. In fact, they paid Quién Compró syndication fees to do it for them.

A global assessment of funding for investigative journalism by the Center for International Media Assistance in 2013 found that staff cuts had reduced newsroom budgets for investigative journalism “despite its frontline role in fostering accountability, battling corruption, and raising media standards” (Kaplan, p. 6). The report found that “investigative reporting receives relatively little support—about 2% of global media development funding by major donors.” It also made a case for the value of this journalism in economic development, citing a study by Transparency International, which asked 3,000 business people in 30 countries how best to fight corruption. A plurality of business people in 21 of the 30 countries chose journalism as their top choice (Kaplan, 2013, p. 10).

Subsidies of print and television

Not all accountability journalism has to be adversarial and reveal corruption. It could simply reveal how effective government and public service agencies are doing their job. This clearly has value to society. For the past half century or so, the main sources of this type of journalism, which requires time, resources, and skilled personnel, have been large, well funded news organizations, generally newspapers and magazines (Picard, 2015a), or television, whether private or public (Barwise & Picard, 2015).

Historically, advertisers have subsidized readers of newspapers and magazines. Because of the “high first-copy cost factor of the creation of content” (Barwise & Picard, p. 186), it was in the interest of publishers to sell as many copies as possible within the limits of cost imposed by distance and time for delivery of their perishable product, the news. And since publishers received 60% to 80% of their revenues from advertising, their incentive was to price the product as low as possible so as to attract more advertising. As Picard observed, “ . . . the most important demand function and price signals were those of the advertiser, with the price signals and quality demands of the reader playing secondary roles” (2015a, p. 155). Publishers would price advertising on the size and characteristics of their audience based on annual surveys. That information, plus the quantity of copies sold and where in the market they were sold—an indicator of socioeconomic status of the readers, and thus their buying power—were reported to an auditing service that provided advertisers with some level of assurance about the audience they were paying to reach.

On the supply side, the publishing business has never been a purely competitive marketplace because of significant barriers to entry. To launch a publication required high capital investment in a printing press and facilities for distribution (Picard, 2015a, p. 151). With the advent of digital publishing, the pricing problem has become much more complex. A two-sided market has become a many-sided one, as Picard graphically illustrated:

The problem occurs because there are paying audiences and advertisers for the print edition, free or paying audiences and paying advertisers for online editions, and some joint audience and advertisers who use both the print and online offerings. If one alters a free price online to create a paying audience, it not only affects the willingness of online advertisers to pay, but affects the willingness of joint audiences and advertisers to pay and thus affects performance of the print sales as well (p.156).

Television offers equally complex challenges. The market is made up of three types of television: free-to-air TV, funded by advertising; public TV, funded by taxes or license fees or both; and cable or satellite TV, funded by consumer payments with some advertising (Barwise & Picard, 2015). Only cable and satellite TV approach something like a competitive market since users pick the products they want and decide whether they want to pay the price demanded by the provider. It is not a pure market, because broadcasters bundle channels together and users may have to pay for channels they don’t want in order to see ones they do. On-demand streaming video services are creating a purer economic market for programming, but have had little effect on journalism.

On the supply side of free-to-air TV, broadcast spectrum is a scarce resource allocated by the government as a public good, so TV has never been a purely competitive market. Because of the high costs of production and of acquiring spectrum, barriers to entry are high. Only well financed organizations can compete (Barwise & Picard, 2015). The United States is one of the few countries in the world that has chosen to let private companies provide free-to-air TV. On the demand side, because consumers pay nothing, they have limited choices among products. Advertisers have heavy influence on programming, which results in “a restricted range of easy-viewing programs” that cost little to produce, such as game shows and reality shows. Broadcasters are less likely to offer expensive-to-produce programming such as “challenging drama, heavyweight current affairs, demanding culture,” which have a small audience and, in the case of news, could offend some advertisers. They have little incentive to serve society as a whole or take a risk on original programming (pp. 168, 176).

In most countries other than the United States, public TV is the predominant medium, as measured by audience size and budgets, and it competes with commercial TV for viewers, talent, and, in some cases, advertisers (Barwise & Picard, 2015, p. 165). Public TV funded by license fees, such as the BBC in the United Kingdom, aims to “maximize viewership and increase the number and quality of programs that commercial broadcasters won’t show” (p. 172).

Barwise and Picard make an economic case for subsidies of some types of programming that have societal value and that the market underprovides. Accountability journalism is one of those types of programming that the market skimps on.

A problem with publicly funded TV is that there are always debates about its efficiency, its programming priorities, and its political tendencies. A concrete example involved RTVE, the public television broadcaster in Spain. When the center-right Popular Party (PP) came to power in 2011, it set about reversing some of the safeguards of impartiality that were instituted under the center-left Socialists (Manfredi & Artero, 2014, p. 166). The country’s economic crisis accelerated what the researchers characterized as a “counter reform” of RTVE, and the PP-dominated Congress began by cutting RTVE’s tax-funded budget by 17% over the previous year, or $160 million. Much international coverage has been reduced or eliminated in regional affiliates. In 2012 the Congress changed the selection process for the president and board of directors of RTVE so that their political affiliation was more important than other qualifications. (pp. 166-167).

Pricing in digital media

Digital media promised to remove some of the unknowns about the audience that were built into the measurement systems used by television and print media. By using freely available tools such as Google Analytics and others, the theory went, an Internet publisher could precisely measure the volume and behavior of its users. The main tool was the “cookie” that publishers’ software placed on users’ browsers to see how many times they visited a website, which pages they viewed, and how long they stayed on each. With this information, a publisher could tell advertisers how many visitors viewed a page on which their ad appeared (an impression). Publishers would charge advertisers using the traditional metric used across all media, namely CPM, or cost per thousand impressions. However, even the best of these systems had problems (Breiner, 2013). Google Analytics, the most widely used, could not measure the time of one of the most common visits, called a “bounce”. A bounce is any visit in which a user looks at one page and then leaves the site without taking any action. For most news organizations, the bounce rate is significant. For example, on Jan. 7, 2016, Alexa.comreported the bounce rate was 57% for The New York Times, 51% for El Pais of Spain, 50% for the BBC, and 31% for Germany’s Bild. Analytics records these bounce visits as lasting for zero seconds, thus pulling down the average time spent on any page measured in the system.

Another problem with web analytics tools is the measure of whether an ad has even been seen—its “viewability.” When a user opens a page, many ads on that page are below the bottom of the screen and thus not viewable unless the user scrolls down. So a user might visit a page, read some of the content, and leave without ever seeing the lower part of the page that contained some ads. Nonetheless, the publisher would record those ads as impressions and the advertiser would be charged. The Internet Advertising Bureau has recognized this problem and shifted the standard for billing from “served impressions” to “viewable impressions” of ads and has come up with standards to address the technical shortcomings (IAB, 2015). However, even the IAB admits that they are inadequate.

In addition, the pricing power publishers and broadcasters enjoyed when they exercised monopolies or oligopolies and thus controlled a scarce commodity—space in print or time in a broadcast—has been wiped away in the world of digital. Digital media continue producing an oversupply of pages for advertisers to choose from, thereby driving down the price in relation to broadcast and print.

The CPM was not the only pricing standard. Publishers charged higher rates for metrics that showed the engagement of users, such as cost per click (CPC), when a user clicked on an ad; cost per action (CPA), if a user downloaded something, filled out a questionnaire, signed up for a service, or took some other action; or commission on sales directly related to the ad.

Measuring user loyalty

In spite of the weaknesses of these metrics, the headline numbers used by media organizations when touting their products still have tended to be monthly unique users, total visits, pages per visit, and average time per visit. These big numbers have concealed some embarrassing realities. A study by Pew Research Center found that 77% of the traffic to the top 25 news sites in the United States came from users who visited just one or two times a month (2011). If they were visiting only once or twice a month, they were not likely to be followers of the brand or loyal to the brand and thus less likely to value the brand. These were not people likely to pay for access to a brand’s digital content. However, some part of that other 23% might be willing to pay, as we shall see.

A later study by Pew Research Center (2014) found that users loyal to the brand of a particular news website often represented a small percentage of the total. The study looked at direct users—those who were consciously choosing the brand by arriving at the site from a bookmark or by typing in its URL. The direct users of The New York Times, for example, came to the site on average just six times a month and spent 9.5 minutes per visit—less than an hour a month. They represented a little more than a third of the Times’ audience, or 37%. Comparable figures of direct users for other news organizations were 60% for CNN, 42% for Fox News, 35% for both the BBC and NPR, and 32% for BuzzFeed. To put these numbers in perspective, the direct users of Fox News, who racked up the most time of any of these media, averaged just over 90 minutes a month, while Facebook was reporting its U.S. users were spending an average of 40 minutes a day checking on the website (Brustein, 2014). These figures show why publishers have been trying to build audiences on Facebook.

Before we finish debunking the most widely publicized and discussed digital metrics—again in the context of the problem of pricing journalism—let’s touch on average length of visit. In a widely shared and discussed article published in Time magazine (2014), Tony Haile, CEO of Chartbeat, a company whose product is measurement and analysis of Web traffic for clients, presented data to make a case for why accepted Web metrics were flawed and needed change. His company analyzed 2 billion page views generated by 580,000 articles on 2,000 websites and found that 55% lasted less than15 seconds. Publishers have traditionally touted the metric of total page views when pricing their products to advertisers, and Chartbeat’s data was calling into question the value of more than half the visits. Haile obviously had a vested interest in promoting new metrics, collectively known as the “attention web” (para. 6), which measures such things as how users scroll through an article, where they pause, and more. The “attention web” touted by Haile would measure not just visits and views but the nature of those visits and views.

Migration of users and advertisers to mobile

Further complicating the pricing of accountability journalism has been the stampede of users and advertisers to mobile platforms. Advertisers and digital publishers—which include legacy print and broadcast media as well as pure player digital media—have been at odds over how to calculate the size of the mobile audience, and thus how to price the service. Existing technology has been unable to track users effectively on mobile devices, especially when they are using applications (Breiner, 2015a, 2015c).

Nic Newman, writing in the Reuters Institute’s Digital Journalism Report for 2015, made no bones about the importance of mobile journalism to the future of news. The study looked at digital trends in 12 countries—eight in Europe plus the United States, Japan, Australia, and urban Brazil. Almost half of smartphone users in the 12 countries (46%) were using their devices to access news every week. Meanwhile, the time that users spend on non-voice mobile has grown to 2 hours 54 minutes daily, which is still behind TV (4 hours and 11 minutes), but has gone far ahead of print (30 minutes) (eMarketer, 2015a). And the last piece of data in this equation is that digital advertising on mobile devices was expected to exceed that on the desktop for the first time in the United States in 2015, according to eMarketer (2015b). Significantly, ad spending on mobile—a total of $30.5 billion—exceeded all print advertising for the first time.

The audience and the advertisers are on mobile, and digital publishers need to find a way to capture both. However, advertisers and publishers are dealing with two other major issues that affect pricing—digital advertising fraud and ad blockers. Bloomberg Business Week reported that digital ad fraud totaled $6.3 billion in 2014 (Elgin et al., 2015), and Ad Age published an estimate that one-third of all traffic to Web publishers was by bots, not humans, and thus fraudulent (Slefo, 2015).

On top of the fraud issue is that of digital media consumers using ad blockers, in effect reducing the size of the audience that publishers can claim in charging for their advertising. Adobe and PageFair cooperated on a study that found 200 million people globally were using ad blockers in 2014, including about 16% of Internet users in the United States, 21% in the United Kingdom, and 25% in Germany. Overall the use of ad blockers increased 41% from a year earlier, the study found, and ad blocking was expected to cost publishers $22 billion in revenue in 2015 (PageFair, 2015).

Publisher anxiety about ad blockers shot up in September 2015 when Apple released its new operating system for mobile devices, which allowed for easy blocking of ads. The anxiety stemmed from the fact that 43% of all time spent by U.S. users on mobile websites was on Apple’s operating system (Marshall, 2015). Apple’s innovation, and the growing use of ad blockers generally, provoked Jason Kint, the CEO of Digital Context Next, the leading online publishers association in the United States, to declare his level of concern at “eight or nine” on a scale of 10 (Kint, 2015, para. 3). He blamed publishers themselves for allowing third-party advertising networks to ruin the mobile user experience by serving up ugly, annoying ads that took forever to download.

Advertisers flee news media

Meanwhile, advertisers continued shifting their dollars from the news media toward digital platforms. Facebook and Google had 40% of all digital advertising globally in 2014, and 72% of all mobile advertising (eMarketer, 2014). Google, Facebook, and other technology platforms are far better than news publishers at targeting ads toward a user’s tastes, interests, habits, economic status, geographic location, and many other factors because those platforms know more about the publishers’ users than the publishers themselves.

Publishers have become dependent on Google and social media to distribute their content to users. In the Reuters 2015 study, more than half of the consumers in nine of the 12 countries accessed news through social networks and search, while in only three countries did most users go directly to the news publisher (p. 75). In this context, the publishers have become simply content providers that the digital platforms use to monetize their own audiences. In 2015, Facebook took the dependency a step further. Its engineers had noticed that when users of its mobile application clicked on links to news articles, the load time was so slow that users often abandoned the articles (Contine, 2015). So Facebook decided to ask news publishers to give their articles directly to the social network with no link back to their own websites in order to improve user retention. As an incentive to divert traffic from the publishers’ own websites, Facebook offered them a share of revenue from ads served next to those articles. Facebook called the service Instant Articles and signed up major publishers, including The New York Times, National Geographic, and BuzzFeed.

Facebook’s competitors reacted quickly. Google, Snapchat, Twitter, and Apple announced plans for similar services, all of which fall under the category of “distributed content.” Publishers have jumped at the offers, which some media observers have viewed as a surrender of their brands to the platforms. Mathew Ingram of Fortune, a longtime analyst of digital media business, worried that while the publishers would gain some exposure and possibly some revenue from Instant Articles, they would lose their brand identity and their institutional value as part of the Fourth Estate:

What the social network has to offer is unquestionably going to help any of those publishers who sign up (and that in turn will create an incentive for others to do so). The risk is that it will wind up helping Facebook more, and that eventually Facebook—a for-profit company that has shown no evidence that it actually understands or cares about “journalism” per se—will become the trusted source of news for millions of users, rather than the publications that produce content (Ingram, 2015, para. 15).

It is not just the platforms that have deprived journalism of its advertising subsidy. The brands themselves have bypassed the news media to create their own websites and marketing campaigns. Numbers tell the story. Ad Age listed the top 10 video ad campaigns for 2015, which racked up from 76 million views for Samsung’s Assemble to 295 million views for Facebook’s “What’s on your mind” (Madov, 2015). Spain’s fast-fashion retailer Zara has 8.7 million followers on Instagram and does not buy advertising. Brands have decided that they don’t always need the media.

The argument for public subsidies

Some economists and public policy experts would argue that accountability journalism is a public good like national defense or the highway system or public education. Public goods are goods and services like streetlights that benefit everyone and that everyone needs but that the marketplace cannot provide: not everyone can afford to pay for them, and no business can serve everyone and make a profit. The argument for journalism as a public good is that it represents a pillar of democracy, the Fourth Estate, a counterweight to political and economic power. This important public role, as we have seen, used to be subsidized by advertising.

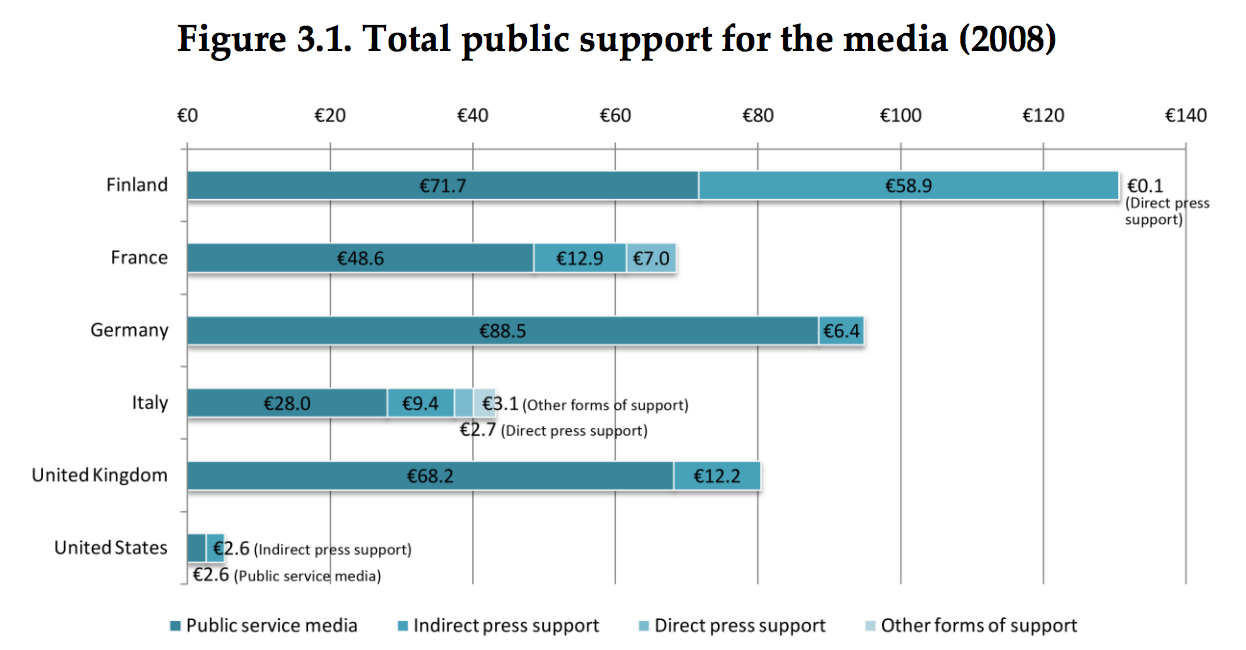

Research by Nielsen and Linnebank (2011) provided data to examine the question of journalism as a public good. They studied the direct and indirect government subsidies of the media in six countries that represent a broad range of approaches and levels of support—Finland, France, Germany, Italy, the United Kingdom and the United States.

Total public sector support for the media measured in euros per capita per annum range from a high of $191 (€130.7) in Finland to a European low of $63 (€43.1) in Italy. The United States, where private sector news media organizations have cut their newsrooms significantly over the last decade, is the country with by far the least extensive system of public support, amounting to an estimated total of $7.6 (€5.2) per capita (p. 4).

In effect, each country has established a price that they are willing to pay for journalism using different economic, social, and political factors.

Figures are per capita. Source: Nielsen & Linnebank (p. 16). Permission granted to republish.

The biggest subsidies in all countries are public service funding to broadcast media, indirect subsidies through reduced taxes (mainly on single-copy sales and subscriptions), and reduced postal rates. Nielsen and Linnebank observed that “the main forms of public support in place today remain the same as they have been for thirty years or more, and are heavily weighted in favor of long-established legacy players and industry incumbents” (2011, p. 15). While supporting legacy media could be viewed as a negative, they concluded that the subsidies might be justified as a public service, given the high reach of newspapers and broadcast TV in the countries studied—44% to 79% of the population got news from newspapers in the previous week and 75% to 97% from TV. These media were “absolutely of central importance” to informing people in these countries, they concluded (p. 20).

While Nielsen and Linnebank made a case for the media subsidies of Nordic countries,Picard argued (2007) that the massive newspaper subsidies there have not always achieved the desired results of increasing circulation or preserving the number of titles (pp. 242-244). Publishers have often perverted the Nordic newspaper subsidies in ways that defeat their public service purpose but serve the publishers’ goals of profitability, he said.

The United States has a long tradition of opposing public subsidies to the media for economic and ideological reasons. House Speaker Paul Ryan, a Republican, is expected to continue to attempt to defund the Corporation for Public Broadcasting (television) and National Public Radio (Mook, 2015). However, McChesney (2013) has tried to make a case for them by arguing that the goal of supporting the news media should be the strengthening of a democratic society. In that context, he tried to show a correlation between government subsidies of media and stronger democracies. He turned to theEconomist’s Democracy Index, which showed the United States ranked 19th among democratic countries when considering factors such as civil liberties, political participation, pluralism, and others. “The top four nations on the list—Norway, Iceland, Denmark, and Sweden—include two of the top three per capita media subsidizers in the world, and the other two are dramatically ahead of the United States”, he wrote (para. 17).

Digital startups

As advertising and subscription revenues have shrunk, and as commercial media have responded by reducing staff and accountability journalism, many new digital media organizations have sprung up around the world to till the gap. Their value propositions are usually exclusive content—often local news—editorial independence, a community mentality that puts users first, and a closeness to their audience, as in a club. These ventures benefit from the low barriers to entry—no need to buy a printing press, a fleet of trucks, a TV antenna, or state-of-the-art studio equipment. They make use of low-cost, freely available production and distribution tools on the Web.

Foundation money has been a stimulus to digital news media in the United States, and it marks a significant difference from other countries in the way these startups have been funded. However, the amounts are relatively small compared to media revenues as a whole. J-Lab tracked $249 million in grants awarded by 279 foundations to 308 nonprofit news organizations over an eight-year period (2013). That $249 million—an average of $31 million per year over eight years—is a drop in the bucket compared to the roughly $1.75 billion annually in direct and indirect government subsidies granted to U.S. media organizations, mainly legacy media (Nielsen & Linnebank, 2011, p. 8)

Researcher and consultant Michele McLellan has identified some 275 digital mediaorganizations (2015a) in the United States that meet the criteria of “progressing on three fronts—content, management, and revenue” (2015b, para. 4). In a survey completed by one-third of those publishers, McLellan found that most were quite small, generating $100,000 a year or less, but they reported steady growth in revenues and audience. Thirteen percent of the publications listed their tax status as nonprofit, 48% were for-profit and the rest did not report that information. McLellan found that 72% of these new digital organizations generated most of their revenue from advertising, which made them extremely vulnerable, in her opinion. Subscriptions or memberships were the main revenue source for only 6% of the publications.

In the United States, the Texas Tribune is recognized as one of the most successful nonprofit digital news organizations. It was launched in November 2009 by software investor John Thornton and magazine editor Evan Smith, who raised $4 million in private contributions as seed funding. The publication has grown to employ 50 reporters covering politics, public policy, and government. It has been held out as a model because of its “revenue diversity, entrepreneurial creativity, and a shared sense of editorial and business mission” (Batsell, 2015, p. 3). In its fourth year, the Tribunegenerated $5.1 million in revenue, with 45% from sponsorship and events, 34% from philanthropic sources, 13% from membership, and 8% from syndication, subscriptions, crowdfunding, and other sources (pp. 7-10).

That kind of U.S. model won’t work as well in most other countries, where foundation money is not as readily available. Across the Atlantic in Spain, where political and business interests heavily influence news coverage, Eldiario.es has marketed itself as an independent news source. CEO Ignacio Escolar founded the digital publication in 2012 and the journalists themselves own it. At the end of 2014, it had 37 full-time employees and profit of $330,000 on revenues of $2 million (Escolar, 2015). It generated a third of its revenue from 11,000 “partners” (socios) who paid $66 a year for the privilege of being able to read articles several hours before non-paying users, and other benefits. It is worth noting that the partners represented only one-fourth of 1% of monthly readers of 4.5 million, meaning that significant revenue can be generated by a small, loyal part of a publication’s online audience. Most of the rest of the revenue came from advertising.

Malaysia and Holland

Another entrepreneurial star in digital media is Malaysiakini, based in Malaysia, which was profiled for the Center for International Media Assistance (Carrington, 2015). Since its founding in 1999 by two innovative journalists, Steven Gan and Premesh Chandran, it has survived many ups and downs financially, battled government attempts to censor content, and in 2014 was reaching an audience of more than 9 million visitors a month (p. 7). Although it is published in four languages—Tamil, Chinese, Malay, and English—only the English version is behind a paywall because that audience is the one most able and willing to pay. Subscriptions totaled more than 16,000 at about $40 each annually.

The Dutch journalism platform De Correspondent launched in 2013 with the promise of being an advertising-free independent outlet of analysis and in-depth investigative reporting funded by annual subscriptions of €60 ($66). Almost 20,000 people responded to the initial crowdfunding campaign and generated $1.7 million, enough to hire a staff of 24. The publication has grown to 34,000 paying members, prompting publisher and co-founder Ernst-Jan Pfauth to argue that journalism can create value and earn the public trust by divorcing itself from advertising (Pfauth, 2015). The publication’s annual report, like that of Eldiario.es, is a model of transparency, showing how it gets and spends money.

Paywalls and micropayments

The loss of advertising and the complications of public funding are forcing digital publishers to look for ways to persuade the public to pay. Surveys and actual market behavior show that a small percentage of digital users will pay, depending on the country, the media brand, payment systems, and technology platforms. The Reuters Institute’s online survey of 24,000 users in 12 countries gives some indication of the consumers’ price point.

Source: Graphic from Newman et al., Reuters Institute digital news report 2015 (p. 66). Permission granted to republish.

The survey found that about 10% of respondents had paid for news in the previous year, ranging from 6% in the United Kingdom to 14% in Finland (Newman et al., 2015, p. 64). The survey found also that the majority would not pay for digital news at any price (see chart above). However, Picard noted later in this report that 24% of those surveyed already pay for digital news or said they would be willing to do so, which he called “a significant proportion” (Picard, 2015b, p. 92).

Digital publishers from the print industry have been using new technology to establish paywalls with varying levels of pricing, accessibility, and permeability. Financial publications such as the Financial Times and Wall Street Journal have long been among the most successful at paywalls, given the exclusivity of their content, the market-moving value of the news they produce, and the fact that many subscribers’ companies pay for the subscriptions rather than the individuals themselves (Jackson & Plunkett, 2015).

A number of companies have developed technology that allows individual print publications to experiment with various types of digital and print subscription offers in order to maximize subscription revenue. In a matter of a few years, more than half of the newspapers in the United States and Canada have now established paywalls, and one company, Piano, began to dominate the industry after a series of acquisitions and mergers. In 2014 Piano Media, which operated paywalls mainly in Europe, acquired U.S.-based Press Plus, which had established paywalls at more than 570 North American newspapers and whose clients included NBC Universal, Time Inc., McClatchy Company, EW Scripps Company, Postmedia Network Inc., News Corp. and IBT Media.

In August 2015, Piano merged with Tinypass, another competitor, to form an organization whose combined clientele includes 1,200 news and media providers on four continents (Piano, 2015). Piano’s CEO, Trevor Kaufman, estimated revenues of the combined companies at $40 million for 2015. One of the main reasons for the merger, he said, was to combine Piano Media’s sales force with Tinypass’s technology, which made it easier for publishers to identify their loyal users and offer individualized pricing options more likely to result in paid subscriptions. Kaufman anticipated growth in digital subscriptions as journalism moves away from support by advertising (Neuts, 2015).

Holland’s Blendle is a growing micropayment service in which users pay for the news they consume, but on a per-article basis. Blendle’s founders have called it an iTunes for news. Launched in 2014, it grew rapidly in its home country, expanded to Germany in 2015, and announced plans to expand into the U.S. market in 2016. The New York Timesand German publisher Axel Springer have invested €3 million ($3.3 million) in the startup. Blendle has signed up 100 large publishers to offer their content on its platform, where users can click articles to read and automatically debit their account by €0.20 to €0.99 per article (22 cents to $1.10), with the publisher keeping 70% and Blendle 30%. The service had more than 450,000 users in Holland and Germany, two-thirds of them under 35, by late 2015 (Filloux, 2015).

Conclusions: Who will pay and how much

The financial setbacks suffered by journalism organizations in the last decade have raised the question of whether journalism is a business or a public service. For the moment, the market is saying that it is both. Some digital media organizations are surviving and thriving without public subsidy. However, the collapse of the traditional business model for journalism supported by advertising has resulted in a huge reduction of the kind of accountability journalism necessary for a healthy democracy. The public, publishers, and policy makers are asking whether the marketplace is capable of supplying that journalism or whether some other sources of funding, such as public subsidies, will be needed.

Filling the revenue gap has been difficult. Digital advertising has been a contributor, but not always the most important one, to the revenue streams of most digital media organizations. It has taken the form of traditional display, sponsorships, or so-called native advertising that mimics the storytelling of journalism. Meanwhile, digital platforms such as Google, Facebook, Apple, Amazon, Snapchat, Instagram, and others have taken over an ever-growing share of digital advertising. Their priorities are commercial—maximizing shareholder value—so they are unlikely to provide the kind of public-service leadership that traditional news organizations could offer with the help of the advertising subsidy. At the same time, advertisers themselves are bypassing the news media to take their messages directly to the public. If that were not enough, advertisers and the public have flocked to mobile devices, which have created complicated problems for publishers in measuring and monetizing their audiences. As a consequence of all this, the press as a pillar of civil society, the Fourth Estate, has been far less able to serve its communities by ensuring that public institutions are providing justice, economic opportunity, public safety, and quality services.

The question of what that information is worth and who will pay for it is being answered in a variety of ways. Paywalls for digital news are providing part of the answer. News consumers realize that they have lost accountability journalism, but the majority have not accepted that they should be the ones to support it financially. Given that the public has been trained to think of online news as free, changing that perception will be difficult.

The Blendle service described earlier is perhaps the closest thing to a pure economic marketplace for journalism. Users don’t have to buy a subscription for an extended period. They pay only for what they consume. They can choose the articles and videos they are interested in from a large and growing selection of media brands, they can see the price of that content, and they can purchase with one click and consume it. And the publisher gets revenue from each of these purchases. The rapid adoption of the service by both users and publishers indicates that it is filling a need. However, the service represents a tiny fraction of the media market.

Digital journalism outlets that focus on accountability journalism are providing part of the answer. These media have demonstrated a value proposition that sets them apart from all of the fluff, entertainment, and socializing on the Internet. The digital news organizations that have developed a brand reputation for producing high-quality journalism, such as De Correspondent, Eldiario.es, Texas Tribune, and Malaysiakini,among others, have been successful when asking their audiences to support them with a subscription, “membership,” or “partnership” contribution. Their credibility is their most important asset in the marketplace, and they reinforce it by being transparent with their audiences about the source and destination of the revenue they generate.

These organizations have developed revenue streams beyond advertising. They have tended to be more innovative than the traditional news media, freed as they are from the burdens of debt and ownership of office buildings, production facilities, and transportation systems. The best and most successful ones have offered news products that are narrowly focused on a geographic area or a topic; they have differentiated themselves by their research, analysis, multimedia, data visualization, or writing; and they have distinguished themselves with their editorial independence from the dominant political and economic powers. Their example shows that digital news media—and all media are becoming digitally focused—can be financially successful, in spite of the collapse of the traditional business model. Still, most are small compared to traditional media. They have not begun to replace all that has been lost.

Public subsidies will likely continue to support media, especially TV, in countries where it has always been a force. But in the United States and other countries that have traditionally rejected subsidies on ideological and economic grounds, they are unlikely to emerge as a new revenue source.

New technological developments could further complicate the digital publishers’ quest for support of this necessary and expensive product we know as public-service or accountability journalism. Or technology could accelerate its recovery. The quest continues, and while it is difficult to predict where the winds of change are taking publishers, there are reasons for optimism. Many users are finding they are willing to pay the price.

Note: All the euro-dollar conversions in article are based on the $1.46 to the euro, which is the figure that Nielsen and Linnebank used at the time of publication.

References

Barthel, M. (2015). Newspapers: Fact sheet. In State of the News Media 2015. Pew Research Center. Retrieved from http://www.journalism.org/2015/04/29/newspapers-fact-sheet/

Barwise, P., & Picard, R. G. (2015). The economics of television: Excludability, rivalry, and imperfect competition. In Handbook on the Economics of the Media, Picard, R. G., & Wildman, S. S. (Eds.). Cheltenham, U.K. and Northampton, Mass.: Edward Elgar Publishing.

Batsell, J. (2015). Earning their keep: Revenue strategies from the Texas Tribune and other nonprofit news startups. Knight Foundation. Retrieved fromhttp://features.knightfoundation.org/nonprofitnews-2015/pdfs/KF-NonprofitNews2015-Tribune.pdf

Breiner, J. (2013). Analytics is undercounting engagement of your users. News Entrepreneurs. Retrieved fromhttp://newsentrepreneurs.blogspot.de/2013/12/analytics-is-undercounting-engagement.html

Breiner, J. (2015a). Mobile metrics are failing advertisers and publishers. News Entrepreneurs. Retrieved fromhttp://newsentrepreneurs.blogspot.de/2015/06/marketers-are-nearly-clueless-about.html

Breiner, J. (2015b). Handful of data journalists shake up Mexican Congress. News Entrepreneurs. Retrieved fromhttp://newsentrepreneurs.blogspot.de/2015/10/handful-of-data-journalists-shake-up.html

Breiner, J. (2015c). ‘Desktop is the new print’ as public goes mobile. News Entrepreneurs. Retrieved from http://newsentrepreneurs.blogspot.de/2015/06/desktop-is-new-print-as-public-goes.html#more

Brustein, J. (2015, July 23). Americans now spend more time on Facebook than they do on their pets. Bloomberg News. Retrieved fromhttp://www.bloomberg.com/bw/articles/2014-07-23/heres-how-much-time-people-spend-on-facebook-daily

Carrington, T. (2015). Advancing independent journalism while building a modern news business: The case of Malaysiakini. Center for International Media Assistance and National Endowment for the Humanities. Retrieved fromhttp://www.cima.ned.org/resource/advancing-independent-journalism-while-building-a-modern-news-business-the-case-of-malaysiakini/

Contine, J. (2015) Facebook starts hosting publishers’ ‘Instant Articles’. TechCrunch. Retrieved from http://techcrunch.com/2015/05/12/facebook-instant-articles/#.hpcpyjx:cBBZ

Elgin, B., Riley, M., Kocieniewski, D., & Brustein, J. (2015). How much of your audience is fake? Bloomberg Business Week. Retrieved fromhttp://www.bloomberg.com/features/2015-click-fraud/

eMarketer (2014). Microsoft to surpass Yahoo in global digital ad market share this year. Retrieved from http://www.emarketer.com/Article/Microsoft-Surpass-Yahoo-Global-Digital-Ad-Market-Share-This-Year/1011012

eMarketer (2015a). Growth of time spent on mobile devices slows: Growth to slow to single-digit pace starting in 2016. Retrieved from

http://www.emarketer.com/Article/Growth-of-Time-Spent-on-Mobile-Devices-Slows/1013072

eMarketer (2015b). Mobile to account for more than half of digital ad spending in 2015: Will surpass desktop for the first time this year. Retrieved fromhttp://www.emarketer.com/Article/Mobile-Account-More-than-Half-of-Digital-Ad-Spending-2015/1012930

Escolar, I. (2015). Las cuentas de Eldiario.es en 2014. Retrieved fromhttp://www.eldiario.es/escolar/cuentas-eldiarioes-2014_6_367523258.html

Filloux, F. (2015). Blendle is up to something big. Monday Note. Retrieved fromhttp://www.mondaynote.com/2015/10/05/blendle-is-up-to-something-big/

Haile, T. (2014). What you think you know about the web is wrong. Time. Retrieved fromhttp://time.com/12933/what-you-think-you-know-about-the-web-is-wrong/

IAB, Internet Advertising Bureau (2015). State of viewability transaction 2015. Retrieved from http://www.iab.com/guidelines/state-of-viewability-transaction-2015/

Ingram, M. (2015, May 13). Is Facebook a partner or competitor for media companies? Yes. Fortune. Retrieved from http://fortune.com/2015/05/13/facebook-new-york-times-instant/

International Consortium of Investigative Journalists (2015). Swiss leaks: Murky cash sheltered by bank secrecy. Retrieved from http://www.icij.org/project/swiss-leaks

Jackson, J. & Plunkett, J. (2015, February 27). Financial Times to change way it charges for online content. The Guardian. Retrieved fromhttp://www.theguardian.com/media/2015/feb/27/financial-times-to-change-way-it-charges-for-online-content

J-Lab Knight Community News Network (2013). Grant support for news projects. Retrieved from http://kcnn.org/nmm-grants/

Kaplan, D. E. (2013). Global investigative journalism: Strategies for support (2d ed.). Center for International Media Assistance. Retrieved from http://www.cima.ned.org/wp-content/uploads/2015/01/CIMA-Investigative-Journalism-Dave-Kaplan.pdf

Kint, J. (2015). 7 important ad blocking issues you need to know. Digital Content Next. Retrieved from https://digitalcontentnext.org/blog/2015/09/24/7-important-ad-blocking-issues-you-need-to-know/

Madov, N. (2015). Facebook’s ‘What’s on your mind?’ was the most-viewed video campaign of 2015: See the Top 10. Ad Age. Retrieved from http://adage.com/article/the-viral-video-chart/see-brands-top-10-video-campaigns-2015-facebook/301904/

Manfredi, J. L., & Artero, J. P. (2014). New business models for the media: The Spanish case. In Psychogiopoulou, E. (Ed.), Media policies revisited: The challenge for media freedom and independence. New York, NY: Palgrave MacMillan.

Marshall, J. (2015, August 28). Apple’s ad-blocking is potential nightmare for publishers.Wall Street Journal. Retrieved from http://blogs.wsj.com/cmo/2015/08/28/apples-ad-blocking-is-potential-nightmare-for-ad-sellers/

McChesney, R. (2013). Digital disconnect: How capitalism is turning the Internet against democracy. New York, NY: The New Press. Retrieved fromhttp://www.utne.com/media/press-subsidies-ze0z1501zhur.aspx

McLellan, M. (2015a). The 2015 state of local news startups. CUNY Graduate School of Journalism, Tow-Knight Center for Entrepreneurial Journalism. Retrieved fromhttp://towknight.org/2015/07/the-2015-state-of-local-news-startups/

McLellan, M. (2015b). Michele’s List: Building blocks in the emerging local news ecosytem. CUNY Graduate School of Journalism, Tow-Knight Center for Entrepreneurial Journalism. Retrieved from http://www.micheleslist.org/pages/1

Mook, B. (2015). New House Speaker Ryan has track record of opposing funds for public broadcasting. Current. Retrieved from http://current.org/2015/11/new-house-speaker-ryan-has-track-record-of-opposing-funds-for-public-broadcasting/

Neuts, D. (2015). Q&A with Piano CEO Trevor Kaufman. Subscription Insider. Retrieved from http://www.subscriptioninsider.com/public/QA-with-Piano-CEO-Trevor-Kaufman.cfm

Newman, N., Levy, D. A. L., & Nielsen, R. K. (2015). Reuters Institute digital news report 2015: Tracking the future of news. Reuters Institute for the Study of Journalism. Oxford. Retrieved from https://reutersinstitute.politics.ox.ac.uk/sites/default/files/Reuters percent20Institute percent20Digital percent20News percent20Report percent202015_Full percent20Report.pdf

Nielsen, R. K., & Linnebank, G. (2011). Public support for the media: A six-country overview of direct and indirect subsidies. Reuters Institute for the Study of Journalism. Retrieved fromhttp://reutersinstitute.politics.ox.ac.uk/sites/default/files/Public%20support%20for%20Media_0.pdf

PageFair (2015). The 2015 ad blocking report. Retrieved fromhttps://blog.pagefair.com/2015/ad-blocking-report/

Pew Research Center (2011). Casual news readers online. Retrieved fromhttp://www.pewresearch.org/daily-number/casual-news-readers-online/

Pew Research Center (2014). 5 key findings about digital news audiences. Retrieved from http://www.pewresearch.org/fact-tank/2014/03/17/5-key-findings-about-digital-news-audiences/

Pfauth, E. (2015). How subscription models lead to more trustworthy journalism. Tinius Trust. Retrieved from https://tinius.com/blog/how-subscription-models-lead-to-more-trustworthy-journalism

Piano (2015). Piano Media and Tinypass merge. Retrieved fromhttps://piano.io/media/Piano_Press_release.pdf?v=1451928833

Picard, R. G. (2007) Subsidies for newspapers: Can the Nordic model remain viable? In Bohrmann, H., Klaus, E., & Machill, M. (Eds.). Media industry, journalism culture and communication policies in Europe. Koln, Germany: Herbert von Halem Verlag. Retrieved from http://www.robertpicard.net/PDFFiles/subsidiesnordicmodel.pdf

Picard, R. G. (2015a). Economics of print media. In Handbook on the economics of the media, Picard, R. G., & Wildman, S. S. (Eds.). Cheltenham, U.K., and Northampton, Mass.: Edward Elgar Publishing.

Picard, R. G. (2015b). The business outlook: Constraints on growth, but some hopeful signs in digital news provision. In Newman, N., Levy, D. A. L., & Nielsen, R. K. (2015).Reuters Institute digital news report 2015: Tracking the future of news. Reuters Institute for the Study of Journalism. Oxford. Retrieved fromhttps://reutersinstitute.politics.ox.ac.uk/sites/default/files/Reuters percent20Institute percent20Digital percent20News percent20Report percent202015_Full percent20Report.pdf

PR Noticias (2014). 11.145 periodistas despedidos y 100 medios cerrados: Triste balance de siete años de crisis. Retrieved from http://prnoticias.com/periodismopr/442-un-ano-de-eres-1/20132555-11145-periodistas-despedidos-y-100-medios-cerrados-el-triste-balance-de-siete-anos-de-crisis-en-los-medios

Slefo, G. (2015). Report: For every $3 spent on digital ads, fraud takes $1. Advertising Age. Retrieved from http://adage.com/article/digital/ad-fraud-eating-digital-advertising-revenue/301017/

James Breiner is visiting professor of communication at the University of Navarra (Spain), where he teaches Media Economics, Multimedia Communication, and Digital Journalism. He is also a digital media consultant with a specialty in entrepreneurial projects. Previously he was co-director of the master’s program in Global Business Journalism at Tsinghua University in Beijing, China. As a Knight Fellow for the International Center for Journalists, he founded and directed the Center for Digital Journalism at the University of Guadalajara in Mexico. He has had a long professional career as a newspaper reporter, editor, and publisher, most of that with the Baltimore Business Journal and Business First of Columbus. As special projects editor at the Columbus Dispatch, he directed an investigative journalism team that won numerous awards from the Associated Press of Ohio.